I sat down with Brian Erickson, Cardwell Beach Chief Marketing Officer, to talk about the luxury market, a world where some of the normal and tried-and-true rules of retail don’t apply. Take a listen for insights into the way we see the global luxury market both recovering and changing in the year to come.

Podcast Transcription

Dave Donars: Hi. Welcome to Air Quotes, the podcast about invisible marketing. My name is Dave Donars. I’m the chief of research at the Cardwell Beach.

Brian Erickson: And my name is Brain Erickson, the chief marketing officer at Cardwell Beach.

Dave: And we thank you to—listening to Air Quotes. Again, telling the name twice. I apologize. But this is the flagship podcast of the Cardwell Beach network.

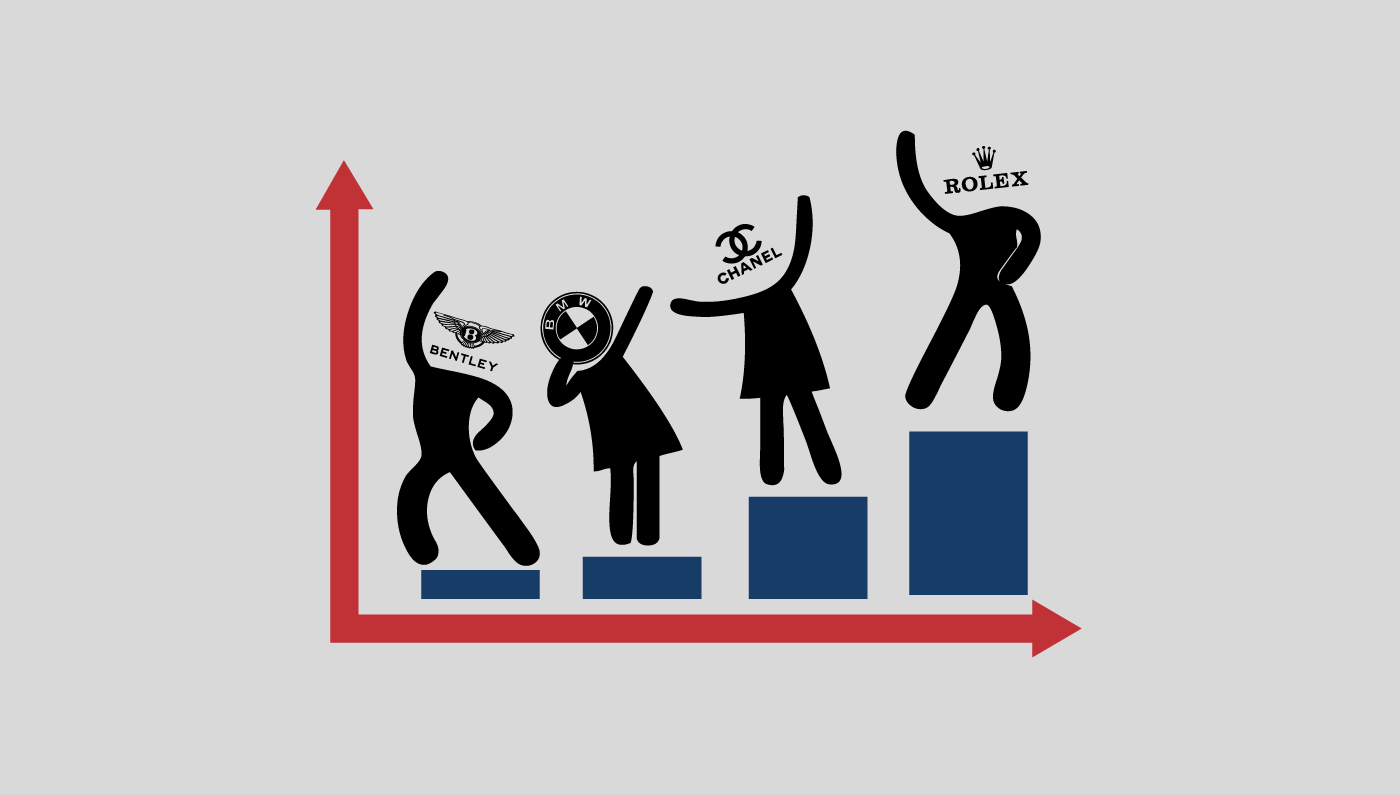

Brian: So today we want to talk a little bit about luxury and, you know, this is based on some conversation we’ve been having internally as well as externally and just kind of some reports that have come out recently on the state of luxury. I think there’s a lot that’s been going on, you know, on a macro level that’s affected every industry and, you know, every, you know, sector of income that luxury is no different. But, you know, there are some things that are specific to luxury that I think are important to address as well. So Dave, you want to kind of just dive right in and let’s just start talking about some things, maybe, you know, want to start with what we had just talked about before this?

Dave: Yeah, sure. I think one of the things that we look forward in 2016 is that we’re entering kind of a new face of luxury marketing. Some of our research show–and this is backup by some of our work with our own clients as well as research has done by Mackenzie and Forester. One of the things that we really see is that luxury on a global level is not a trend that raises all boats. We’re seeing certain countries within Europe and United–and, you know, the United States is always the stalwart for the luxury market. And in Asia really is starting to shift their purchases from something that more value conscious or maybe even mid-tier luxury to extremely high-end luxury purchases. I think the countries that are really worth highlighting here are Singapore, to an extent South Korea, China, what we see in the United States and in Europe, England and weirdly enough Moldova. But I think Moldova has replaced Russia as a major source for–not overwhelming but it’s getting a lot of influx of high income Russians that are coming to Moldova, maybe something of some tax havens, maybe moving some of their business or at least their banking properties over there. Because there’s been a lot of instability with Crimea and some sanctions and the declining ruble over time that Moldova which simply was not on the map in 2014 for luxury purchases is now kind of cracking into the top 10. That doesn’t mean Russia is falling out, but you are seeing–I think a way that we can explain that wealth transfer now that Moldovans became suddenly super wealthy but it is–it is Russian money being purchased in a more stable European market than what’s happening in Russia right now.

You know, if you think about it, you want to break out the luxury brands into a few different areas. You’re going to have services in particular which have very little macro-economic effects on that except for something like a great recession or depression or currency crisis or something like that. Like pure service end when you’re talking about personal assistance, drivers, car usage those type of things are not too elastic to are macro-economic situation. However, when you get into purchase items, jewelry, somebody extremely high-end tech things or with vacations, you see things that are more elastic or sensitive to price variations and into macro-economic situations. All of that being said, I think that we want to kind of having filter of the luxury market into three different faces, one is prior to the recession, one if during the recession and now, this is 2016. We are fully out of the recession. No one should be in penny and cents mode anymore. And what that means? So, especially within digital purchases and consumer purchases, we’ve seen a lot of things prior to the recession where relatively small amount of the very, very wealthy and a very small portion of true luxury goods have purchasers that were what we called tech savvy.

Brian: And just to jump in there for second Dave and, you know, reference the luxury shopping in the digital age report by Mackenzie. I thought a really fascinating statistic was that three out of four luxury shoppers owned a smartphone which is probably less than the general public. You know, and I think that’s because there are people doing that type of thing for them in a lot of instances. Am I right?

Dave: Yeah, yeah. That’s what we see. You know, and we can look at syndicated reports like Mendelssohn. We can look at our ethnographic research that we do internally here and it’s really validated across the board. That on the extreme high end, high, high income, high purchased luxury buyer that you’re seeing them not necessarily do things online. The internet is not a personal thing to them in many ways or–I’m speaking of a pre-recession mentality. Now, when you look at this extreme high wealth because obviously the people who are a little bit older, you know, there not–there’s more 60-year-olds that have a million dollars and there’s more 80-year-olds that has a few million dollars and there are 18 or 20-year-olds that have million dollars. So some of this makes sense. But you got to get into that mentality. You’re exactly right that people do things for them. So you’re telling somebody to purchase a gift or bookification of do this or do that. And things in–that prior or recession face that just simply didn’t matter like the user interface or the story of the brand or all of that like that was all just kind of la-di-dah. What really matter was the in store experience, some type of professional, personal sales approach that just simply wasn’t digital. Moving into the recession brands did suffer especially the mid-tier luxury.

Now, we’re talking about products that–or obviously not for mass consumptions. So to talk about, mid-tier luxury sounds, you know, like I’m saying jumbo shrimp or something, but it’s–it has some value to differentiate between these levels. You know, you can go and then buy some Mikimoto necklaces. Some of them will come in at the, you know, $25,000 range and they’ll go up to maybe even $300,000 range on the extreme custom stuff. So that’s a very wide price point that people are entering from. But during the recession you’ve seen kind of those–the newer people who are being amerce into the luxury brand who merely make one or two these purchases, for them it’s a–it’s a big, big purchase to them in their own personal finances versus at the corporate bottom line. You saw digital opened up a more effective way.

Brian: Could we–just everyone take it back for second there and, you know, reference the conversation we were having about stores and areas like Greenwich, Connecticut for instance and the hours that they’re open. Just talk about that for a second and the reason that that had traditionally been the case.

Dave: Yeah. I mean I think this is a little less true right now. But I mean even through the recession what we’re dealing with was extremely high end couture stores. You know, maybe there’s only two or three stores in the country or in the world. They don’t have much of an e-commerce presence. And their stores hours are what has, you know, generally have been referred to in the industry as luxury hours. These are the hours between 9:45 AM and 4:45 PM. Sometimes even when you get into Europe with an hour break in the middle of the day, these are–these are stores where you’re going to have a personal shopper with you. You’re going to be taking care of to an extraordinarily high degree. But they are expecting you to, you know, buy mass volume. And the hours were always an issue because obviously a lot of people are working during those hours. Those are key prime work hours for at least. You know a lot of people. Unless you’re–per shift that’s basically the first shift of work. Moving in to second and third shift, I know there’s some differences. But it was always just this more gentile, more kind of class based system where if you had enough money to buy this, you probably weren’t working was kind of the mentality. Now, coming out of the recession, one of the things that happened was that a digital experience opened up for those buyers who are having some, you know, really interest in buying some of these products but don’t–can’t expend $300,000. Maybe they can spend 15,000. That old experience, you didn’t necessarily want somebody who’s spending a lot of money. $15,000 is a lot of money on a piece of jewelry. You don’t necessarily want them in the same store footprint as people who are going to be spending a lot more. It was always considered to be bad juju. I don’t know. Bad manners or something along those lines.

What we saw during the recession was a change, modification to get in with those Henry’s and so sometimes called in the market, so that they could have a very good and effective digital experience. An e-commerce experience, its open 24 hours a day and that a company could volumetrically, collect a lot of information. They could collect the revenue. They could start somebody on a buyer journey to become a life-long customer without kind of conflicting with that personal shopping experience. Now that we’ve come out of the recession, we’re in the third face and that is, that we’ve seen a lot of those high-end buyers want to have the same conveniences that they’re given to the Henry’s, the lower-end purchasers. So they want more dynamic store hours. They want very personalize attention. They care about UI in a way that just simply didn’t matter a few years ago. They want a website to remember who you are. They want–they want the story. They want the information about the heritage of the brand, because you’re only buying luxury for really one of two reasons. One is–and this is extreme high luxury. One is for a gift and the other is for yourself. But in either situation it’s not necessarily the product itself that’s going to telegraph and brightly show all the differences it has. And we’re beyond the level of talking about price point or specifications or ways that it’s improved. It’s about the heritage of the brand.

You know–I mean some of these of brands are spent decade and decades trying to cultivate a market for things like Mikimoto spent–maybe the first 25 years of their company convincing people that they had found real pearls and that pearls were this very valuable item in the market place. That is something that just didn’t exist before. They had to create consumer appetite and go with it. The heritage of those type of brands about the craftsmanship and the trade that goes into making something that may cost 10, 15, 20 times more than a competitor, that’s no longer about specifications or anything. It’s really about the heritage. And that story and the way that you tell that story needs to be put in digital now because more and more purchases are moving there.

Now, initially, a few years ago, we would have seen a lot of the stuff go to desktop. But we’ve obviously seen a lot of goods. Even in this market we’re only three out of four people have smartphones. We’ve seen more and more purchase it to a mobile environment. This is true. Very–across the board except in two areas, automotive and travel. Those are still more desktop heavy. And that make sense if you think about from the user experience. When you’re shopping around for a trip or things like that, maybe you’re looking at different location. You want to see the big screen and you might have a few itineraries of, you juggling a few things. Also travel itineraries are still probably done at this extremely high level. We were talking about hotel rooms that are–let’s say $4,000 a night and up kind of hotel rooms. These are still probably done by personal assistance which is why we see the desktop stuff. On the other end, it’s just not a good experience to necessarily book travel entirely through a phone yet. The UI is not there. But in all this other…

Brian: So I would–actually I just pause you for second there on UI and, you know, come back to a point you made a minute or two ago about that, you know, there are really high expectations of UI in a luxury market. And, you know, it’s kind of interesting when you think about how demanding the average consumer is from user interface, you know, about a user interface, and they’re not even somebody who’s accustom to getting every little thing that they want at any moment that they wanted. And there is that high level of expectation. So when you’re dealing with a luxury customer, that is multiplied, you know, at least 10 fold. I mean is that a first statement?

Thanks for listening. Please join us next week when we continue our discussions about luxury marketing.